CryptoMakers review – is it a scam, fraud, or a Legitimate broker – 2021

Our CryptoMakers review – is it a scam Broker or not?

Dear Reader. Our review is created for you if you are interested in passive income or a fascinating new job. First, we will talk about trading with a broker. We chose CryptoMakers broker as a counterparty.

In our review, we will tell you what you will have to do as a trader. How can you profit and how should you interact with CryptoMakers broker.

A broker is an intermediary – a legal entity between an investor and an issuer (trader). That is, between you (the buyer) and the company (the seller).

Therefore, you can’t trade without a broker. Unfortunately, there is no way to buy any asset directly if you don’t have a broker licence.

To become a trader and start trading, you need to open an account with a broker. Therefore, we will start this review in order.

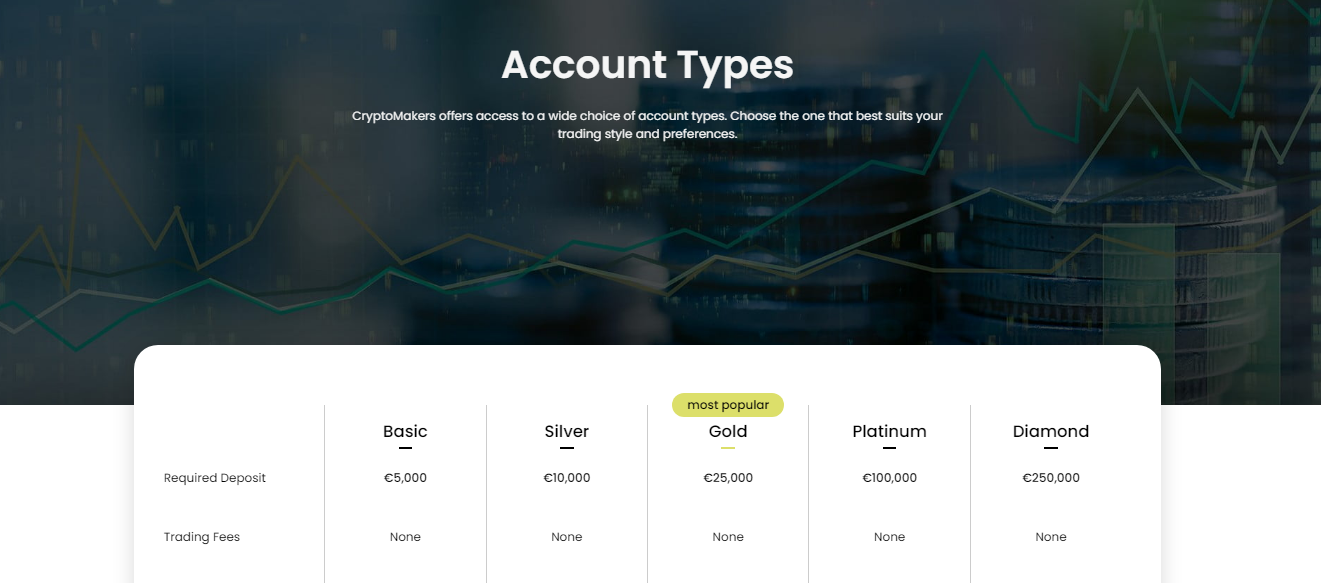

CryptoMakers Review – Type of Deposits – 9/10

CryptoMakers review and their Type of Deposits. There is five account types that CryptoMakers broker offers.

The minimum is € 5,000. There is no maximum, the sky’s the limit 😉

- “Basic” (from € 5,000 to € 10,000).

Account manager – Counsel,

Withdrawals approvals – 5 business days,

Direct Financing – 25%,

Leverage – Up to 1: 5,

Spreads – From 1,5 Pips,

Education – 1 Analyst session,

IPO Access – By invitation.

- “Silver” (from € 10,001 to € 25,000).

Account manager – Counsel,

Withdrawals approvals – 3 business days,

Direct Financing – 50%,

Leverage – Up to 1: 30,

Spreads – From 1,0 Pips,

Education – 3 Analyst sessions,

IPO Access – Priority.

- “Gold” (from € 25,001 to € 100,000).

Account manager – Customized,

Withdrawals approvals – 24 hours,

Direct Financing – 100%,

Leverage – Up to 1: 100,

Spreads – From 0,5 Pips,

Education – Online course,

IPO Access,

Copy Trading,

Money management plan,

Access to premium Contest.

- “Platinum” (from € 100,001 to € 250,000).

Account manager – Customized,

Withdrawals approvals – 4 hours,

Direct Financing – 4 hours,

Leverage – Up to 1: 300,

Spreads – From 0,0 Pips,

Education – Full Program,

IPO Access,

Copy Trading,

Money management plan,

Access to premium Contest – Weekly,

Saving account.

- “Diamond” (from € 250,000 )

Account manager – Customized,

Withdrawals approvals – Swift,

Direct Financing – Customized,

Leverage – Up to 1: 500,

Spreads – From 0,0 Pips,

Education – Full Program,

IPO Access,

Copy Trading,

Money management plan,

Access to premium Contest – Daily,

Saving account,

Negative Balance Protection.

It is still better to indicate all accounts and not classify the last type of “Platinum.” Therefore, we set – 9.

We also see that the broker takes care of clients and gives little leverage for small deposits.

This way, we won’t lose a lot of money if we make a mistake in our strategy. Thus, the broker protects us from significant losses. Special thanks to him for such thoughtfulness and care.

Account types:

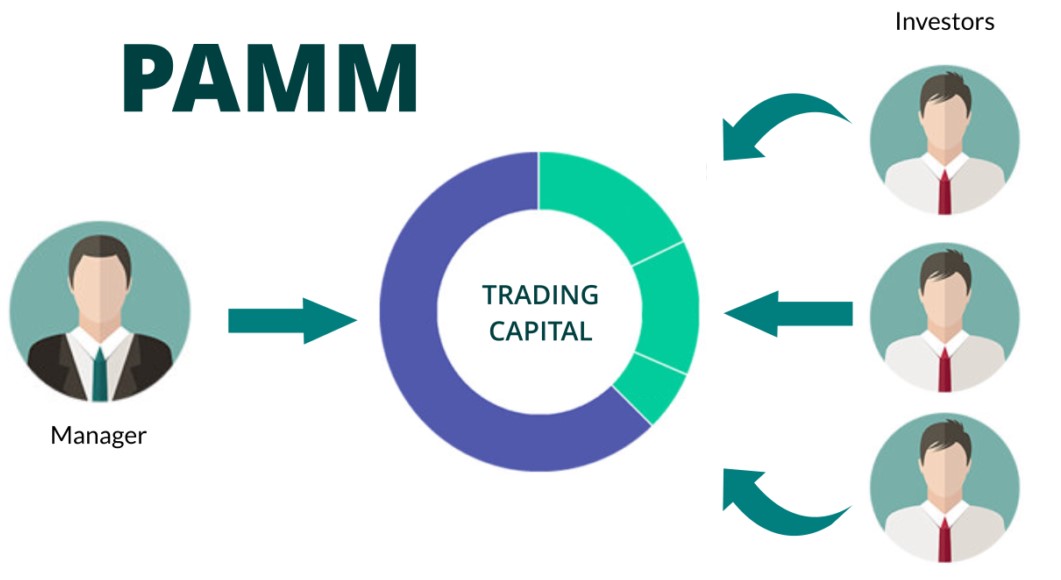

The broker provides clients with the following tools: pamm accounts and social Trading.

In addition to the regular Trading account, we may have other arrangements for particular actions. After some time, you can open different accounts. For example, if you become a successful trader you will be given an option to become a leading trader in Social trading.

That means traders will have the option to follow your trading and profit using your trading strategies. It’s a win-win for you and the trader that is going to follow you.

You are going to profit a percent of the commission that the traders that are going to follow you will pay for CryptoMakers. Win for you.

The trader that is going to follow you will be profiting without actually trading. Win for the trader that is going to follow you.

PAMM – If you do not want to open trades yourself, you can be an investor in a PAMM account or follow a profitable trader (copy their trades) in social Trading.

Learn more about these tools

PAMM-account (from English Percent Allocation Management Module, PAMM – percentage distribution management module) is a form of trust management. When an investor privately transfers money to a trader, he invests it and, if successful, receives a certain percentage.

The meaning of the auto-follow strategy is that other traders can join a particular manager who manages his money. He has access to manage this account, but he cannot withdraw funds. Thus, the trader – the manager, oversees all transactions, and the trader – the investors, will only receive profit on the PAMM accounts for how successful the trader-manager was in operations.

A trader can get a decent amount from commissions with successful management and many brokers, even with small investment.

The trader’s income grows depending on the number of transactions. The broker also receives a commission as the brokers’ balances are linked to their accounts.

One of the ways to make money on trades is front-running (in translation from English – “running ahead”). If a trader has many funds that he can manage, he can manipulate the market. If he is interested in “accelerating” the securities of a company, then using PAMM accounts, for example, he can buy a lot of shares, and the price for them will begin to rise. Then, when it is profitable for the trader, sell them, and the price will fall.

It is better to study the operation of a PAMM account using an example.

For example

The trader John has registered as a manager with a large forex broker, in this case its CryptoMakers. He opened an account, published an offer in which he indicated the terms of investment and distribution of profits.

John invested his money, let it be $ 2000. Then, to get the attention of investors, he started trading.

After 1-2 months, interested parties saw that John was showing good profitability. Then they decided to invest in his PAMM.

If John profits, then neither investors nor John needs to distribute funds independently, which happens automatically. In addition, the broker controls the process so that all parties are reliably protected from fraud.

Social Trading –

Social trading consists of communication on social networks, where brokers exchange opinions and strategies. New or inexperienced investors can start trading by copying the process of other traders.

The main advantage of social Trading is open access to the knowledge of the entire community. In addition, social platforms provide numerous metrics that show characteristics such as risk level, profitability, trading experience, number of winning or losing trades, etc.

One of the risks associated with social Trading is that traders must trust the trading decisions that others make. The disadvantage of this strategy is that the beginner bears the entire risk. Which are watching other traders as they invest their own money. And brokers – newbies are themselves responsible for losses without shifting it to someone else. Of course, any profit will also belong to them.

Such tools deserve a minimum grade of – 10/10

We would actually grade it 20/10 but 10 is the 100% 🙂

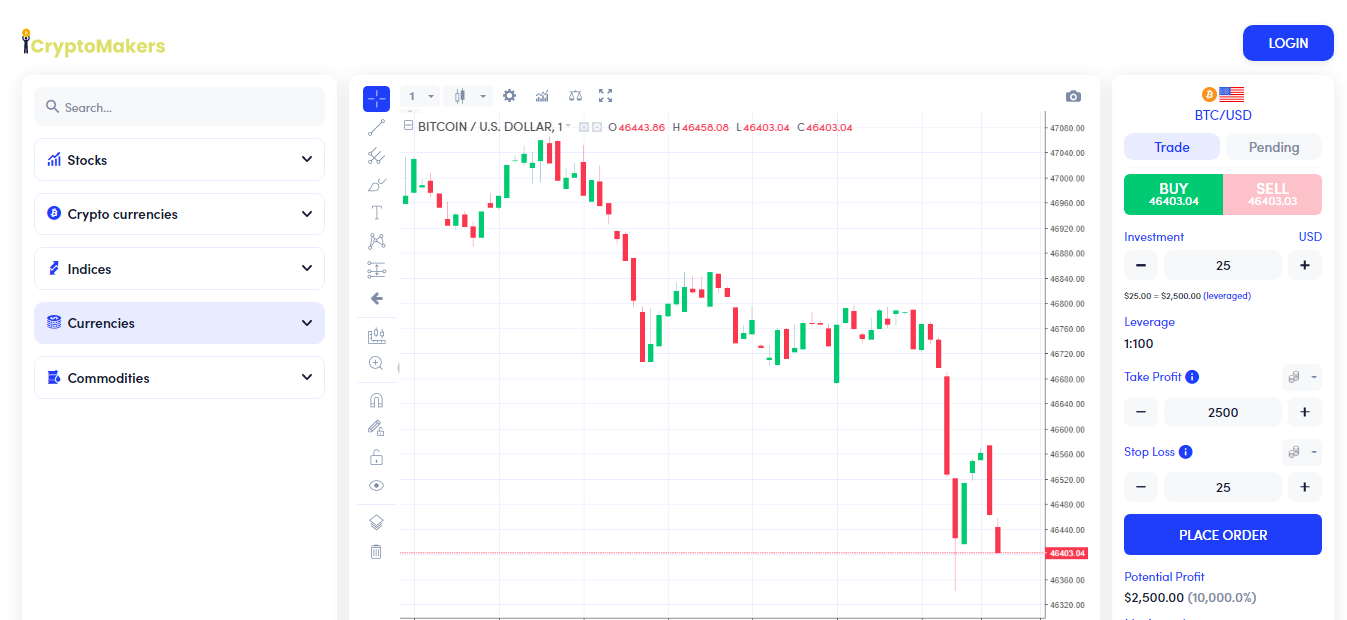

CryptoMakers Review- Broker trading platforms

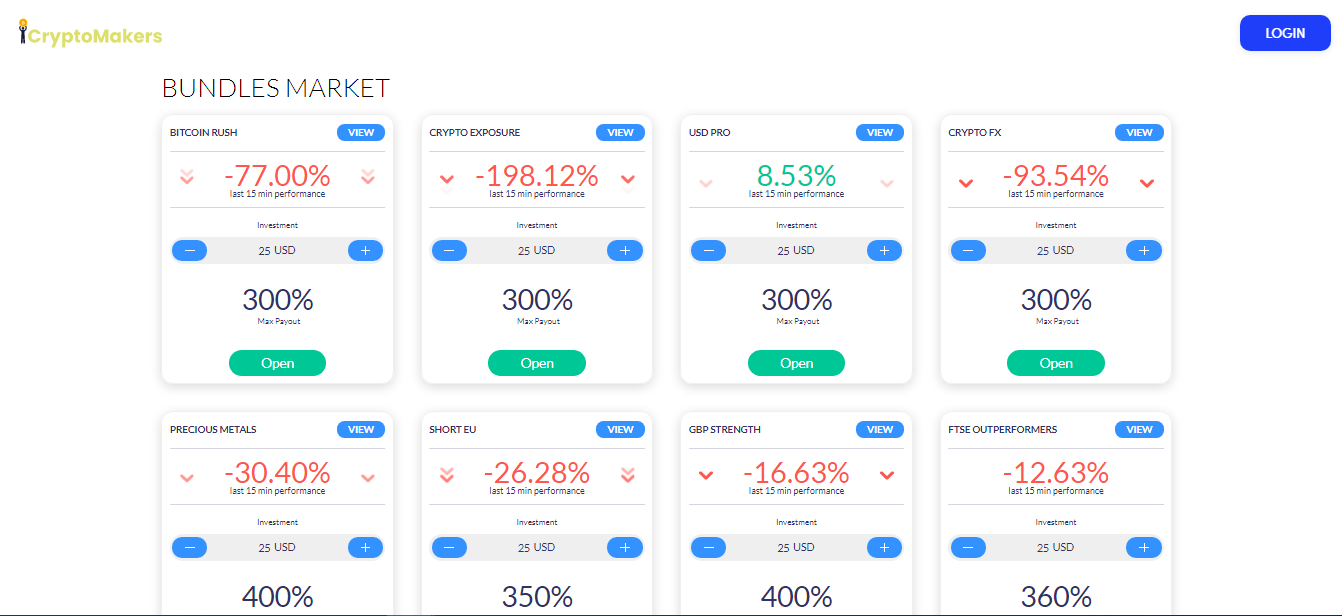

Broker CryptoMakers has developed two platforms for trading clients: CFD and ETF.

You can trade on these platforms from any device, both of them are optimized for any format.

1. CFD is the standard platform for Forex trading. Access to all assets and over 200 trading instruments. The principle of Trading is simple, and on this site, the broker provides for buying and selling: stop loss, take profit. Stop loss for setting the minimum price. Take profit at the maximum price.

The broker also allows you to use pending orders, that is, buy/sell at a specific asset value when the asset reaches that price. The trader determines himself for what price he is willing to buy/sell.

2. ETF – a platform for investing in a set of assets collected together in 1 product. It looks something like auto trading. The client chooses only in which of the 13 groups he wants to invest. And the trader buys at a specific price and waits for the product to increase according to the stated forecast by 100% or more, if it looks like a good offer, you can choose to invest in this particular ETF. The broker assembles everything. You decide how much and in which ETF to invest. Convenient for beginners, because you don’t have to trade on a few different assets simultaneously. Instead, you just trade on 1 ETF contract.

We rate it 9/10

Because, we would like to see more ETFS

Conclusion: CryptoMakers Review – A great broker trusted by many.

As you can see, CryptoMakers rating is 9.34 out of 10.

The CryptoMakers broker has many advantages: various types of accounts, many tools for charting and trading (pamm accounts, signals, etc.).

The broker provides auto trading. “Passive” income if you may, since you as a trader dont have to trade at all, because the robot trades for you.

As a result, this is how you can interact with the CryptoMakers broker and receive the desired income.